When to use:

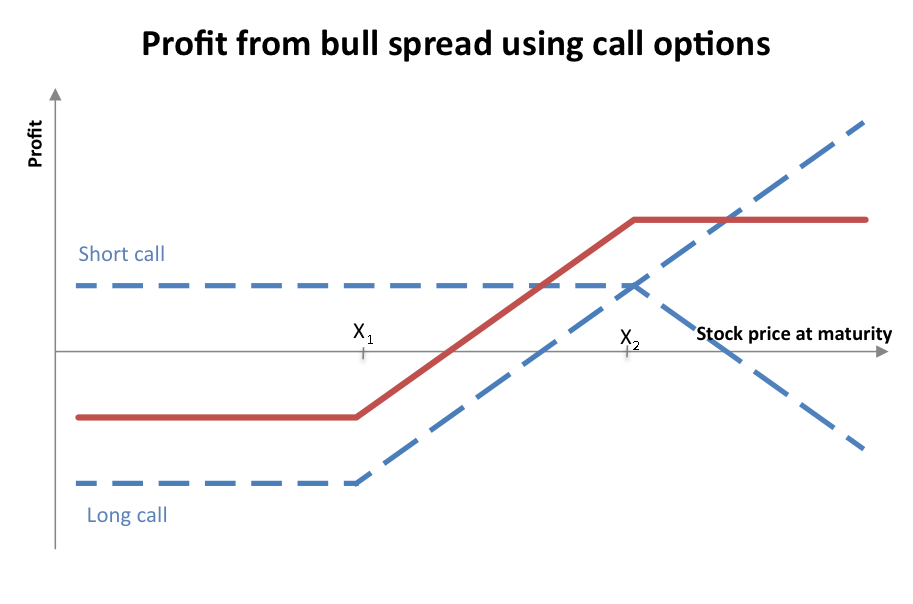

A bull call spread is constructed using two call options.And

it means to by buying a call option with a low strike price, and selling

another call option with a higher.The bull call is one of the Bullish

Strategies . It consist of two call in same underlying stock .

Buy 1 in the money call option

Sell 1 out the money call

option.

Bull Call Spread option trading strategy is used by a trader

when he thinks the market is bullish in nature and expects the underlying stock

to give decent returns in the near future. When trader sell(write) a call, He

will receive premium which results in reducing the cost for buying an ITM Call Option.

However, the profits are also minimized. This strategy is also called as ‘Bull

Call Debit Spread’.

An options strategy that involves purchasing call options at

a specific strike price while also selling the same number of calls of the same

asset and expiration date but at a higher strike. A bull call spread is used

when a moderate rise in the price of the underlying asset is expected.Often the call with the lower exercise price will be at-the-money

while the call with the higher exercise price is out-of-the-money.

Both calls must have the same underlying security and expiration month. If the

bull call spread is done so that both the sold and bought calls expire on the

same day, it is a vertical debit call spread.

A strategy with limited risk and predictable reward, used

when a stock's price is anticipated to rise.

Risk:

The maximum loss is very limited. The worst that can happen

is for the stock to be below the lower strike price at expiration. In

that case, both call options expire worthless, and the loss incurred is simply

the initial outlay for the position.

Profit :

The maximum profit is limited to the difference between the

strike prices, less the debit paid to put on the position The maximum gain is

also limited. If the stock price is at or above the higher (short call) strike

at expiration, the investor would exercise the long call component and

presumably would be assigned on the short call. As a result, the stock is

bought at the lower (long call strike) price and simultaneously sold at the

higher (short call strike) price. The maximum profit then is the difference

between the two strikes prices, less the initial outlay (the debit) paid to

establish the spread.

Example:

Suppose

that the NIFTY is trading around 8100 level. And if you want to enters into

Bull-Call-Spread strategy. You brought one 8100 ITM Call Option for a premium

of Rs. 165, and sells one 8300 OTM Call Option for Rs. 55.The lot size of NIFTY

is 25.Hence the net investment will be only Rs. 5500

1.Buy

8100 call option 165*25=4125

2.

Short 8450 call option 55*25=1375

Case 1: At expiry if the NIFTY dips down to 8000 level,

the maximum loss will be only Rs. 5500.i,e our total investment of both the

calls.

Case 2: At expiry if the NIFTY closes at 8200 level, net

profit will be Rs. 6000.

8100

call at expiry day is Rs 100.

8300

call at expiry day is 0 which means we can get the total short amount.

So

total loss is 100*25=2500

Short

call option 55*25=1375

3875

Total Loss is 5500-3875=Rs 1625

Case 3: At expiry if the spot NIFTY closes at 8400 level,

the intrinsic value of the 8100 ITM call will be Rs.300 and that of 8300 OTM

call will be Rs. 100. At expiry, the cash settlement will be done with a credit

of Rs.

8100 call at expiry day is Rs 300

8300 call at expiry day is Rs 100

Total Profit:

Profit in 8100 call =300-165=135*25=3375

Loss in 8300 call=100-55=45*25=1125

Total

Profit=3375-1125=Rs 2250

Really so informative blog and these types of blog or article very useful for investors because there is lots of information about market…

ReplyDeleteThank You,

MCX Call in Silver

Really so informative blog and these types of blog or article very useful for investors because there is lots of information about market…

ReplyDeleteOptions trading provide the right but not the obligation to buy or sell a security before the agreed price. Option trading involves risk that is why only risk capital can be suggested in trading.

ReplyDeletestock tips

nice written post about Option trading Strategy 4: Bull call spread

ReplyDeleteThanks,

Crude Oil Trading Tips

what stt i has to bear if a bull call spread expire in the money

ReplyDelete