When to use:

It is one of the types of option trading strategy. A Short Put Options, also known as Naked Put option strategy. When selling a put option, you are following a sequence of sell-hold-buy, or just sell hold. You are selling your option first, hoping for the price of the better still, you sell-hold and if the market value of the underlying Stock is above the strike price, the option has no intrinsic value and you have no need to buy back at all.

The seller of a put option is hoping that the market value of the underlying stock will rise, or remain flat, as this will result in a decrease in value of the put option. The seller can then buy back the option at a lower price and realize a profit. Alternatively, if the value of the underlying stock is above the strike price of the option, it is highly unlikely that the option will be exercised. The buyer of the put option is not going to sell their stock at a price lower than the current market price

Example:

It is one of the types of option trading strategy. A Short Put Options, also known as Naked Put option strategy. When selling a put option, you are following a sequence of sell-hold-buy, or just sell hold. You are selling your option first, hoping for the price of the better still, you sell-hold and if the market value of the underlying Stock is above the strike price, the option has no intrinsic value and you have no need to buy back at all.

The seller of a put option is hoping that the market value of the underlying stock will rise, or remain flat, as this will result in a decrease in value of the put option. The seller can then buy back the option at a lower price and realize a profit. Alternatively, if the value of the underlying stock is above the strike price of the option, it is highly unlikely that the option will be exercised. The buyer of the put option is not going to sell their stock at a price lower than the current market price

In this Strategy, the seller will simply wait until the

expiry date, at which time the option will expire worthless. The seller would

retain the premium they received on the initial sale of the option as a profit.A

Bullish options strategy that involves selling short or "writing" a

put option. The

put options expire worthless and entire premium from its sale is earned by the

trader. A trader will Selling puts are often seen as a way to make money in a neutral

market. A trader will short the put option if he thinks market is bullish in

nature and expects the underlying stock not to fall below a certain limit. l short put if he is bullish in nature and expects the

underlying stock not to fall below a certain level.

There are several potential advantages in selling

cash-secured puts to covered calls. The first is that you pay one commission as

opposed to two. (This assumes that you are not assigned, and don't incur the

fees that would come with assignment.) Risk management is typically easier with

the one position. Puts also often command higher premiums than calls and

therefore offer better potential returns. The best way to analyze this is by

using the comparative implied volatile.

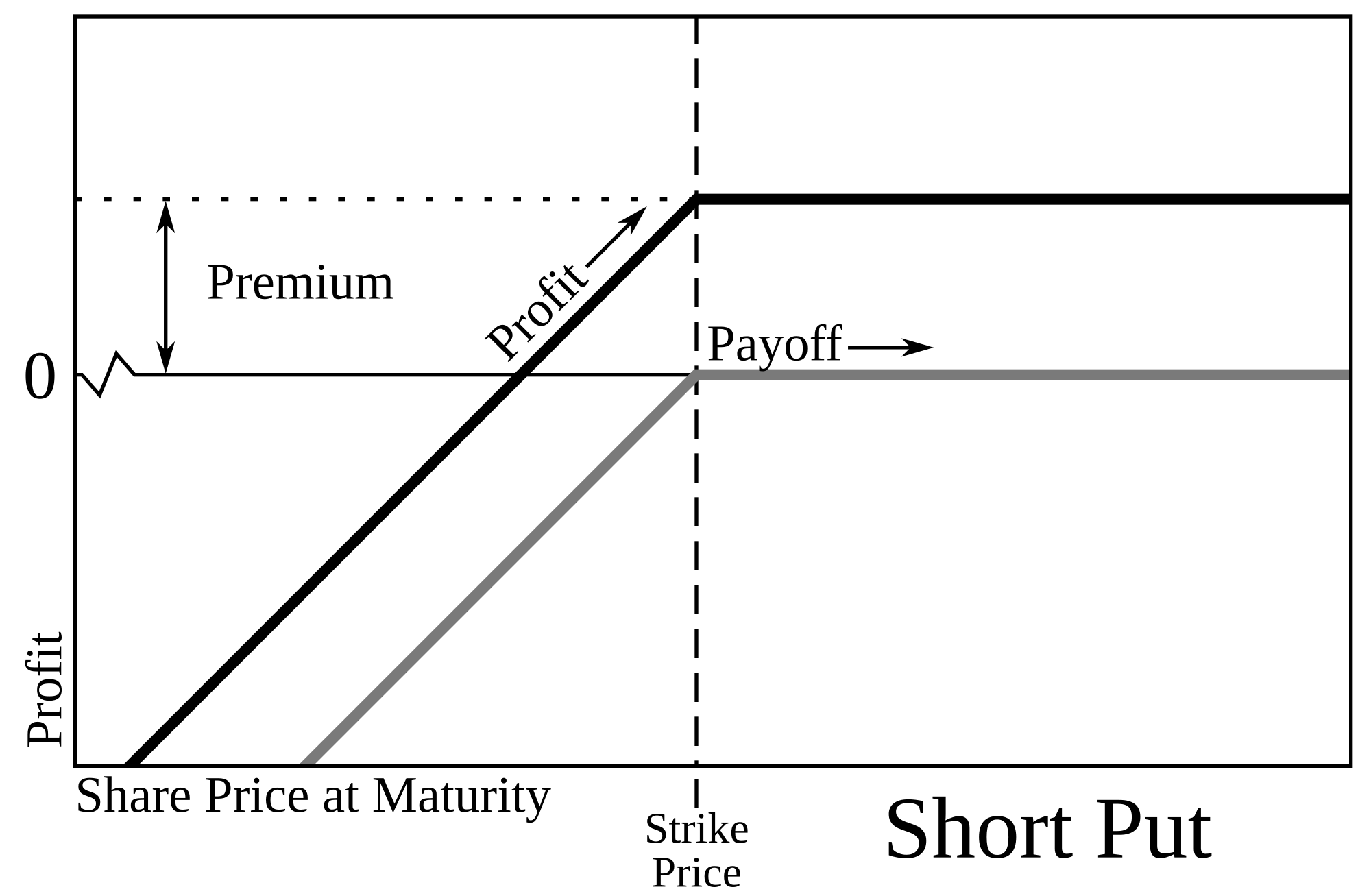

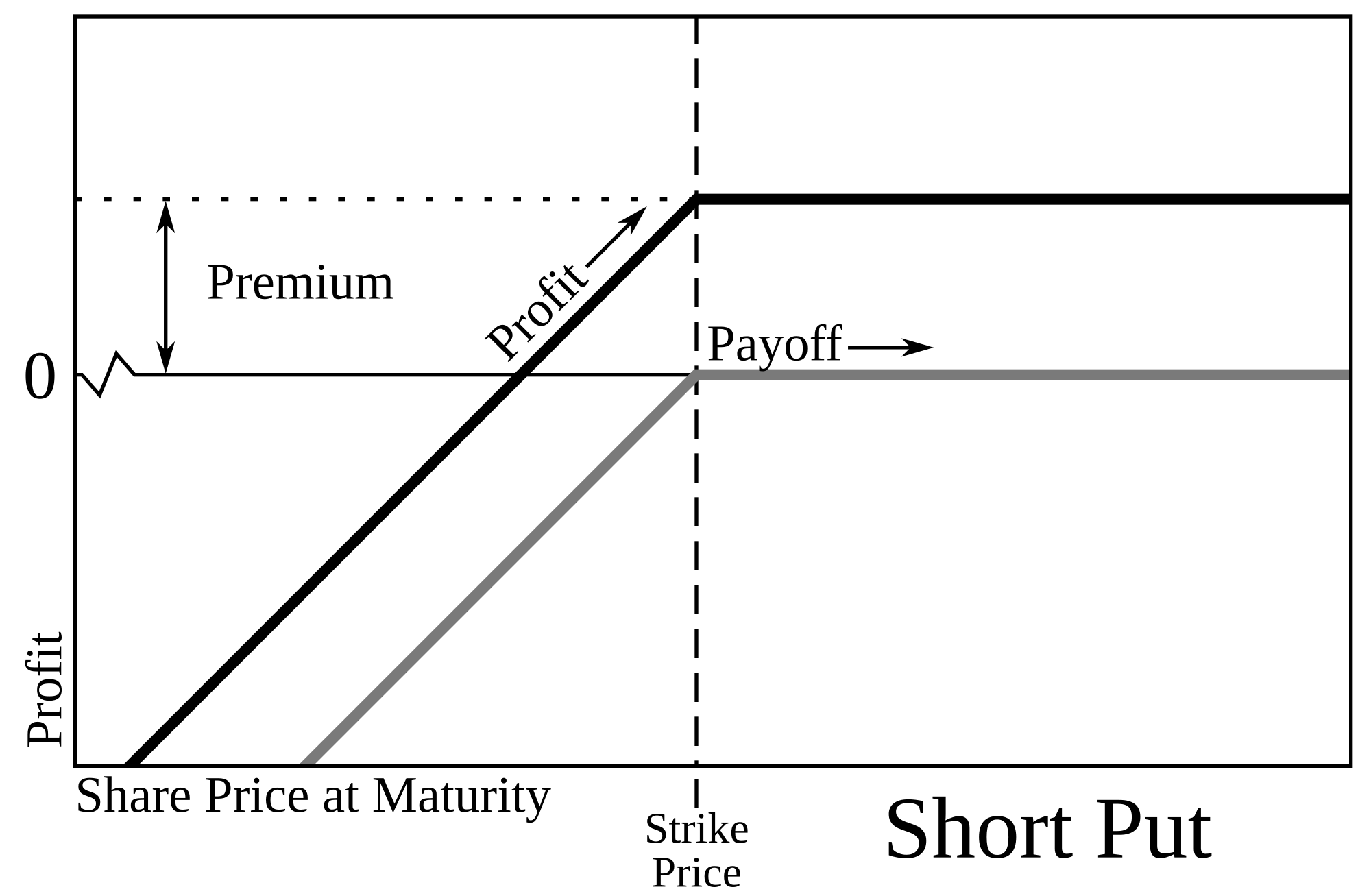

Risk:

Unlimited Losses will be there if the stock

skyrockets above the trade strike price of put.

Profit:

Profit will be capped by the premium amount of

the put option. Limited to the amount of premium can be collected by trader.

The seller of the short put (gets the premium) is betting the stock price will

be above the strike price on expiration so he can keep the premium amount of

the put option.

Example:

Suppose NIFTY is trading at 8800

Level. If you think the current market situation is bullish on this month and you

expect the NIFTY to stay near 8800 to 9000 levels or even rise further until expiry.Hence

you will sell one NIFTY 8800 Put option for a premium of Rs.

. X is bullish on the market. He

expects NIFTY to stay near

5200-5300 levels or even rise

further until expiry. He will sell one NIFTY 5200 Put Option for a premium of

Rs 90. Lot size of Nifty is 25.

Your total investment:

Option 5800 put -90 *25 =2250.

Case

1:

If the NIFTY

closes at 5800, then you will receive the maximum profit of Rs. 2250.

If nifty close the 5800 level in

expiry day then the 5800 put should be 0

So you can get the full short amount

of the put.

Case 2:

If the NIFTY closes at 8600 level then you will loss

Rs 2750

If Nifty closes 5600

level in expiry day then the 5800 put value will be 200 (5800-5600).

This comment has been removed by the author.

ReplyDeleteYour blog for nifty futures tips updates are very useful to read, you can take advice from Epic Research also.Epic Research

ReplyDeleteNice Post. The mani purpose of option trading either it is buying or short a call put is to reducing risk through hedging and arbitraging.Equity tips

ReplyDelete